What Sets Female Critical Illness Insurance Apart?

The Ministry of Health has reported that cancer strikes one in every nine Malaysian women. What’s worse, an estimated 60% of cancer prognosis among patients in Malaysia is detected at later stages.

On top of that, 45% of cancer patients face financial problems due to late detection which leads to higher cost of treatment.

The cost of cancer treatment could exceed 30% of family income after a year of being diagnosed. (Source: The Star, New Straits Times)

Hence, it is important to be financially protected with a critical illness insurance plan.

One may think that a basic critical illness plan would suffice as it covers all types of cancers, including female-related cancers; however, that is not the case.

What are the types of female critical illness coverage?

Unlike basic critical illness plan, female critical illness plan offers coverage for specific diseases or events that faced by women in particular.

This plan covers 2 major types of female critical illness coverage:

Female Carcinoma In Situ and Cancers for:

- Breast

- Cervix Uteri

- Uterus

- Fallopian Tube

- Ovary

- Vagina / Vulva

Female Illness: Systemic Lupus Erythematosus with Severe Kidney Complications

The best part of a female critical illness is the Recovery Benefits.

This benefit worth 30% of the total Sum Assured or RM25,000, whichever is lower, and is claimable up to 2 events for any one of the common events such as follows:

- Osteoporotic Fracture

- Rheumatoid Arthritis

- Facial Reconstructive Surgery due to Cancer of Accident

- Skin Grafting due to Burn or Skin Cancer

- Reconstructive Surgery of breast, cervix uteri or vulva/vagina

- Removal of breast, cervix uteri, uterus, fallopian tube, vulva/vagina or ovary

On top of these main benefits, some female critical illness plans also come with extra benefits such as Pregnancy Benefits, Child Care Benefits, Cash Reward Benefits and Maturity Benefit.

| Extra Benefits | Descriptions |

| Pregnancy Benefits | Carrying a child can be magical as well as challenging for some mothers-to-be. This benefit cover events that affect both the mother and baby and is claimable once |

| Child Care Benefits | This benefit is extended to the newborn baby if affected by special events as listed out by the insurer and is claimable one time only |

| Cash Reward Benefits | This is a personal achievement benefit whereby the insurer will award you with cash rewards for achieving some milestones in your life |

| Maturity Benefits | This benefit will be paid out to you 100% of the Sum Assured when your policy has reached its maturity, provided that you never made a claim before. |

Female Cancer Benefits and Coverage

A women-specific critical illness plan pays greater attention to diseases that concern women's well-being and health.

In Malaysia, the most common cancer among women is breast cancer, which accounted for 32.7% of all female cancer patients.

There are 4 stages of breast cancer; if one got diagnosed at the first or second stage, she will have a higher chance of survival.

With that in mind, a female critical illness plan is set to increase the chances of Insured Person's survival by including early stage female cancer coverage, also known as Female Carcinoma In Situ.

Female Carcinoma In Situ

A Carcinoma In Situ (CIS) is a group of abnormal cells that form and grow in the same place. Although it is sometimes referred to as "pre-cancer", CIS is non-invasive as it occurs at stage 0.

At this stage, CIS is usually 100% curable when followed up with proper treatments.

Female critical illness plan offers high coverage for 6 early stage female cancers mentioned above. The coverage amount can go up to 100% of sum assured with zero premium top up.

You don't need to add on a rider plan to enjoy early stage cancer coverage when you are covered under female critical illness as this benefit is part of the whole female critical illness plan.

Bounce-back or Power Reset Features

A typical critical illness insurance will pay you out in tiers when a claim has been made based on the severity or stage, which then will reduce its basic sum assured accordingly.

When a subsequent claim is made after that, you will receive the reduced amount of sum assured.

However for a female critical illness plan, a Power Reset or Bounce-back features is introduced to maintain optimum protection for the ladies.

What a Power Reset or Bounce-back does is that it reverts the coverage amount for end stage cancer claim back to 100% of sum assured, several months after a Carcinoma In Situ claim is made.

Instead of you receiving the balance of reduced sum assured after your first claim, female critical illness replenishes your coverage amount so that you can claim a higher coverage for your end stage cancer.

See insurance products comparison table below for illustration:

Recovery Benefits

Mrs X purchased a female critical illness plan with Bounce-back / Power Reset features for a sum assured of RM50,000. One year later, she was diagnosed with Cervix Carcinoma In Situ. Several months after her early stage Cancer claim, she is diagnosed with Stage IV Cervix Cancer.

| Compare Female Critical Illness Insurance Plans | ||

|---|---|---|

| Basic Sum Assured | RM50,000 | RM50,000 |

| CIS Payout (Early Stage) |

50% of Sum Assured (RM25,000)

|

50% of Sum Assured (RM25,000)

|

| Bounce-back / Power Reset |

Revert to 100% of Sum Assured

6 months after CIS payout |

Revert to 100% of Sum Assured

12 months after CIS payout |

| Cancer Payout (End Stage) |

100% of Sum Assured (RM50,000)

|

100% of Sum Assured (RM50,000) |

The main focus of a female critical illness insurance plan is the treatment and recovery.

When diagnosed with a breast cancer, an insured person will not only receive an early stage payout, but also recovery benefits that include surgery to remove cancer cells and/or to reconstruct the breast.

That's not all, a female insurance plan takes importance in your well-being in other aspect of life.

For example, AIA A-life Lady 360/-i provides psychotherapy treatment and menopause treatment benefits for you to cope with emotional and psychological episodes.

See table below for a list of benefits that a female critical illness plan supplements on top of cancer benefits.

These benefits, however, may vary from one insurer to another, therefore, it is best that you consult an agent before buying one.

| LIST OF FEMALE CRITICAL ILLNESS BENEFITS | ||

|---|---|---|

| Breast Cancer Recovery | Female Well-being | Female Treatment |

| Breast lumpectomy | Hormone replacement benefit for menopause | Reproductive organ surgery |

| Breast reconstructive surgery & mastectomy | Psychotherapy treatment | Loss of female reproductive organ |

| Medical complications | Facial reconstructive surgery | |

| Income indemnity | Skin grafting or skin cancer | |

| Snatch theft payout | Severe rheumatoid arthritis | |

| Osteoporotic fracture | ||

Benefits for both Mommy and Baby

Carrying a bundle of joy for 9 months is wonderfully risky. Understanding that this experience is unique for some mothers-to-be, a female insurance plan has designed a Maternity Benefit that will help absorbs some risks.

Whenever you choose to conceive, early or late in the years, Maternity Benefit will cover pregnancy complications such as eclampsia, late miscarriage, death of foetus and ectopic pregnancy.

That's not all, your precious little one will also be covered in special cases like down's syndrome, cleft lip or cleft palate, spina bifida and many more.

Life Achievements Benefits

Remember that girl who was happily sketching her future life on a piece of paper where 3 human figures holding hands in front of a house? That is a law of attraction!

Get married, have a baby and buy a house (or vice versa); the sequence does not matter, but what matter is achieving your life dreams is rewarding under a female critical illness plan.

Not only you will get a financial protection in the events of female illnesses and pregnancy complications, but you will be rewarded with cash too when you hit a milestone in your journey.

Let's look at the table of life achievement benefits between 2 products below, the percentage will be calculated from your basic sum assured and will be paid out in cash to you!

| CASH REWARD BENEFITS | ||

|---|---|---|

| Prudential PRULady | ||

| Marriage | 3% | 3% |

| Childbirth | 3% | 12% |

| Retirement/golden age | 9% | 12% |

| Property purchase | 3% | - |

| Death of spouse | 9% | - |

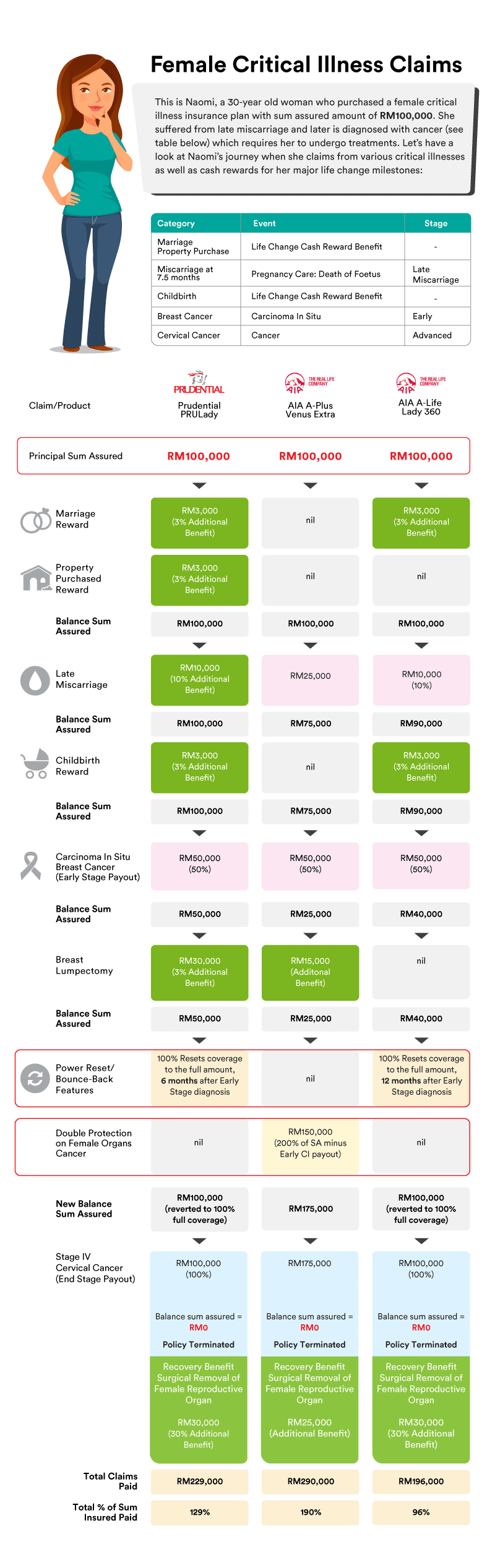

Here's an illustration to show you how female critical illness claims work:

|

|

Prudential PRULady | AIA A-Plus Venus Extra |

AIA A-Life Lady 360 |

| Summary of Benefits for Naomi |

Gives her cash rewards for life-changing events.

Sum Assured bounces back to 100% after 6 months from Early Stage Cancer diagnosis. Total protection against female-related illness, pregnancy complications and child hereditary illnesses. |

Immediate protection for Mothers-to-be and newborns.

Sum assured resets to 200% (after Early Stage Cancer payout deduction) If she is looking for a plan that protects both mom and baby, this is a suitable plan for her. |

Extra coverage for breast cancer (removal and reconstructive surgeries).

Sum Assured resets to the full amount (100%), 12 months after Early Stage Cancer is diagnosed. If female related critical illnesses runs in her family or cause her the most anxiety, get this plan. |

Compare and Apply Female Critical Illness Insurance Plan Online

The female critical illness insurance plan should not be viewed as a substitute for your life insurance plan.

Instead, it should complement your current life insurance plan to get you maximum financial protection against bot generic and female-related illnesses.

The plan should be purchased in addition to a basic Medical Insurance or Term Life Insurance (if Female coverage is not sufficient or included).

Compare and apply for the Best Female Critical Illness Insurance now!